When you’re buying groceries, running an online business, or managing invoices, knowing how to calculate with tax is important.

This guide walks you through how to add tax to a price and how to remove tax from a total, with examples and a calculator.

🙋♀️ What Does “With Tax” Mean?

A price with tax includes the original price of the item plus a percentage added as sales tax or value-added tax (VAT). This rate varies depending on your country or region.

For example, if an item costs $100 and the tax rate is 13%, the price with tax is:

$100 + ($100 × 13%) = $113✏️ How to Add Tax to a Price

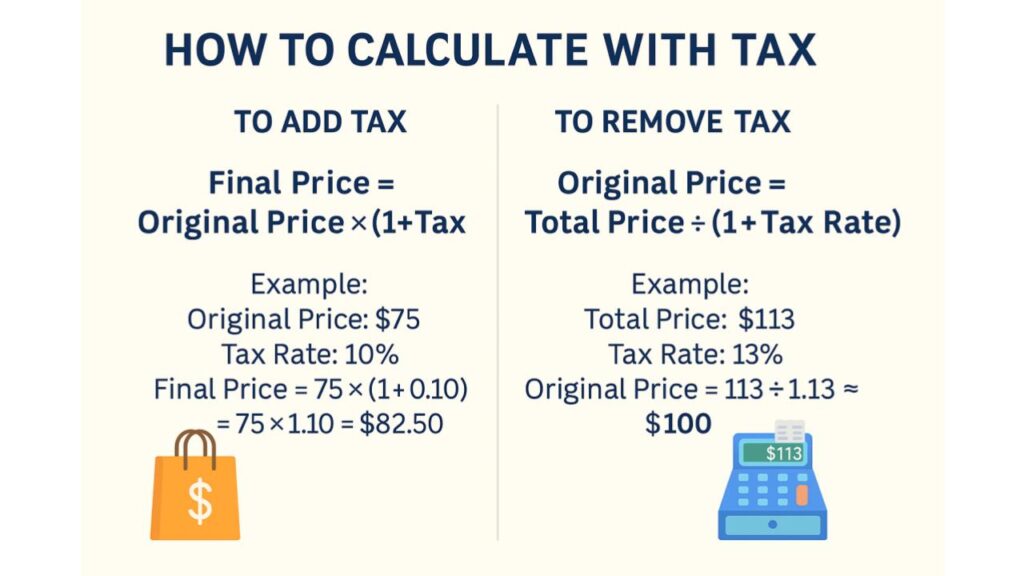

Here’s the formula:

Final Price = Original Price × (1 + Tax Rate)Example:

Original Price = $75

Tax Rate = 10% = 0.10

Final Price = 75 × (1 + 0.10) = 75 × 1.10 = $82.50🔄 How to Remove Tax from a Price

If you know the total price including tax, you can find the original price like this:

Original Price = Total Price ÷ (1 + Tax Rate)Example:

Total Price = $113

Tax Rate = 13% = 0.13

Original Price = 113 ÷ 1.13 ≈ $100

📦 When to Use Tax Calculations

- Consumers: To estimate the final price when shopping

- Business owners: To create accurate invoices

- Freelancers: To understand how much tax you’re collecting

- Accountants: To break down totals for reporting

💡 Pro Tips

- Always convert percentages to decimals in calculations (e.g., 15% = 0.15)

- Use a calculator for quick and error-free results

- Confirm your local tax rate—many regions have different rates for different items