🏢💰 Enterprise Value (EV) is one of the most important metrics in corporate finance. It tells you the total value of a company — not just what shareholders own, but also what a buyer would need to pay to acquire the entire business.

In this article, we’ll explain how to calculate enterprise value, what it includes, and provide a calculator to help you estimate it quickly.

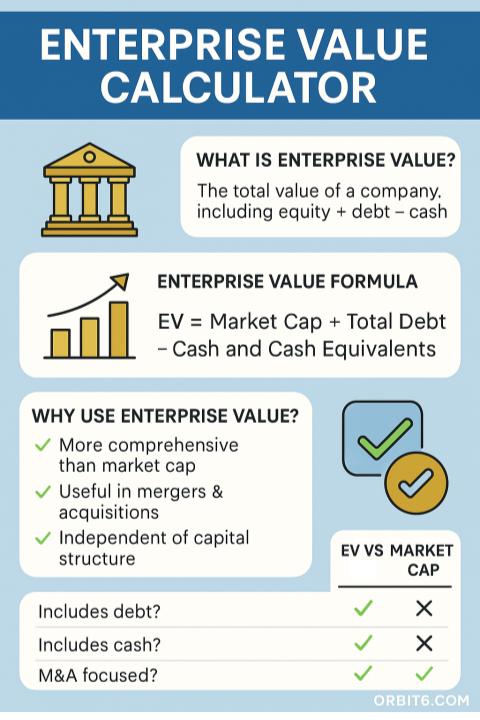

🙋♀️ What Is Enterprise Value?

Enterprise Value represents the full value of a business, including its equity, debt, and cash. It shows how much it would cost to purchase the entire company, including debt obligations and cash reserves.

It’s widely used in:

- Mergers and acquisitions

- Valuation modeling

- Ratio analysis like EV/EBITDA and EV/Sales

Use the calculator below to instantly estimate enterprise value based on market cap, debt, and cash.

🧮 Enterprise Value Formula

The basic formula for Enterprise Value is:

EV = Market Capitalization + Total Debt – Cash and Cash EquivalentsWhere:

- Market Capitalization = Share Price × Total Shares Outstanding

- Total Debt = Short-term + Long-term debt

- Cash and Equivalents = All liquid assets

💵 Example Calculation

Let’s say a company has:

- 10 million shares outstanding

- Share price = $40

- Total debt = $200 million

- Cash on hand = $50 million

Step 1: Market Cap = 10M × $40 = $400 million

Step 2: EV = $400M + $200M – $50M = $550 million

That’s the true cost to acquire the business.

⚖️ Why Enterprise Value Matters

Unlike equity value, which only shows the value for shareholders, EV provides a complete picture by including debt and subtracting cash.

It helps you:

- Compare companies with different capital structures

- Calculate more accurate valuation multiples

- Understand the actual “takeover price” of a company

🔁 Related Posts

- Equity Value Calculator